|

Venture

Technology Merchants, LLC. is a leading firm

directed to corporate finance, venture investment and merchant

banking. Our philosophy incorporates 'demand pull' staffing, whereby

our substantial network and partnership of operating managers, investment

bankers and investors are assembled per project. This ensures the

optimum team is engaged at all times. As well, this allows us to

assess and execute engagements of any manner and size, free from the

incessant overhead and associated time and performance pressures that

plague the 'bulge bracket'. Such constraints often cause the very

best opportunities to be overlooked. Our staff and merchant partner

bios are available on request. Venture

Technology Merchants, LLC. is a leading firm

directed to corporate finance, venture investment and merchant

banking. Our philosophy incorporates 'demand pull' staffing, whereby

our substantial network and partnership of operating managers, investment

bankers and investors are assembled per project. This ensures the

optimum team is engaged at all times. As well, this allows us to

assess and execute engagements of any manner and size, free from the

incessant overhead and associated time and performance pressures that

plague the 'bulge bracket'. Such constraints often cause the very

best opportunities to be overlooked. Our staff and merchant partner

bios are available on request.

Angus

Macdonald is President and a founder of Venture Technology Merchants,

LLC. Mr. Macdonald has been involved in hundreds of

transactions ranging from small, bench start-ups, to dozens and dozens of

public equity, bond and convertible offerings, to

personally initiating one of the largest industrial mergers in

history.

Prior to co-founding VTM, he was a senior officer of Lehman Brothers, Inc. (Now

Barclay's Capital) There he worked as a securities analyst heading up the

Health Care Special Situations effort. This broad category allowed

Macdonald to focus on disparate companies in health care ranging from

biotech to devices, to instrumentation to specialty finance.

Prior to joining Lehman Brothers, Mr. Macdonald was senior analyst at Fahnestock, Inc. (now

Oppenheimer), where he covered the medical devices, biotechnology and

environmental industries.

Mr. Macdonald's work has been recognized by banking clients, investors, and

the financial press. His public and industry research has been also

extensively chronicled by the above and in various polls for stock picking,

earnings accuracy and industry knowledge. Macdonald has also been

recognized in objective polls directed to top industry operating and

executive management. This recognition selects the Wall Street

professional deemed to best understand the companies he calls upon.

Before publishing on Wall Street, he was President of Macdonald &

Associates: a private banking firm performing merger and acquisition

advisory. The firm also delivered valuations and investment opinions

directly to institutional clients. Frequently, these were difficult,

specialty analysis projects focused on companies in transition, in turn

around or rapid growth modes. Thus, conventional sell-side research

had typically broken down or faltered in these dynamic circumstances. This

bottom-up, comprehensive research frequently led to the establishment of

major investment positions for institutional clients.

Angus Macdonald began his management career at Bethesda Research

Laboratories (a pioneering biotechnology and research products company) in

the early 1980ís. He was director of business development there; bridging

the gap between the then top molecular biology team at BRL, and large

pharmaceutical and chemical industry partners. When BRL missed the IPO

window of 1982, Macdonald was appointed by the CEO and the Board of BRL to

develop the cash flow plans for rationalizing the company. This came out

well, as to this day BRL product lines comprise the core of Life

Technologies, itself having recently been acquired by Thermo Fisher Scientific.

He later served as CEO of AGR Corporation, the former Berkshire Cable

Television. Berkshire sold its Western Massachusetts CATV system in

1983.

Macdonald holds a BA in Biology (concentrations in Physiology, Molecular Biology

and German Literature) from the University of

Pennsylvania, and an MBA from Britain's Cranfield,

where he was recognized in 1980 by the British

Institute of Directors in their annual competition and award for

entrepreneurship.

He is a director of numerous private companies and serves on the board, the

compensation committee and is chairman of the audit committee of FLIR Systems, Inc., the leading global company

providing advanced infrared imaging and thermography

products. Macdonald is credentialed as an Advanced Professional

Director with the American College of Corporate Directors.

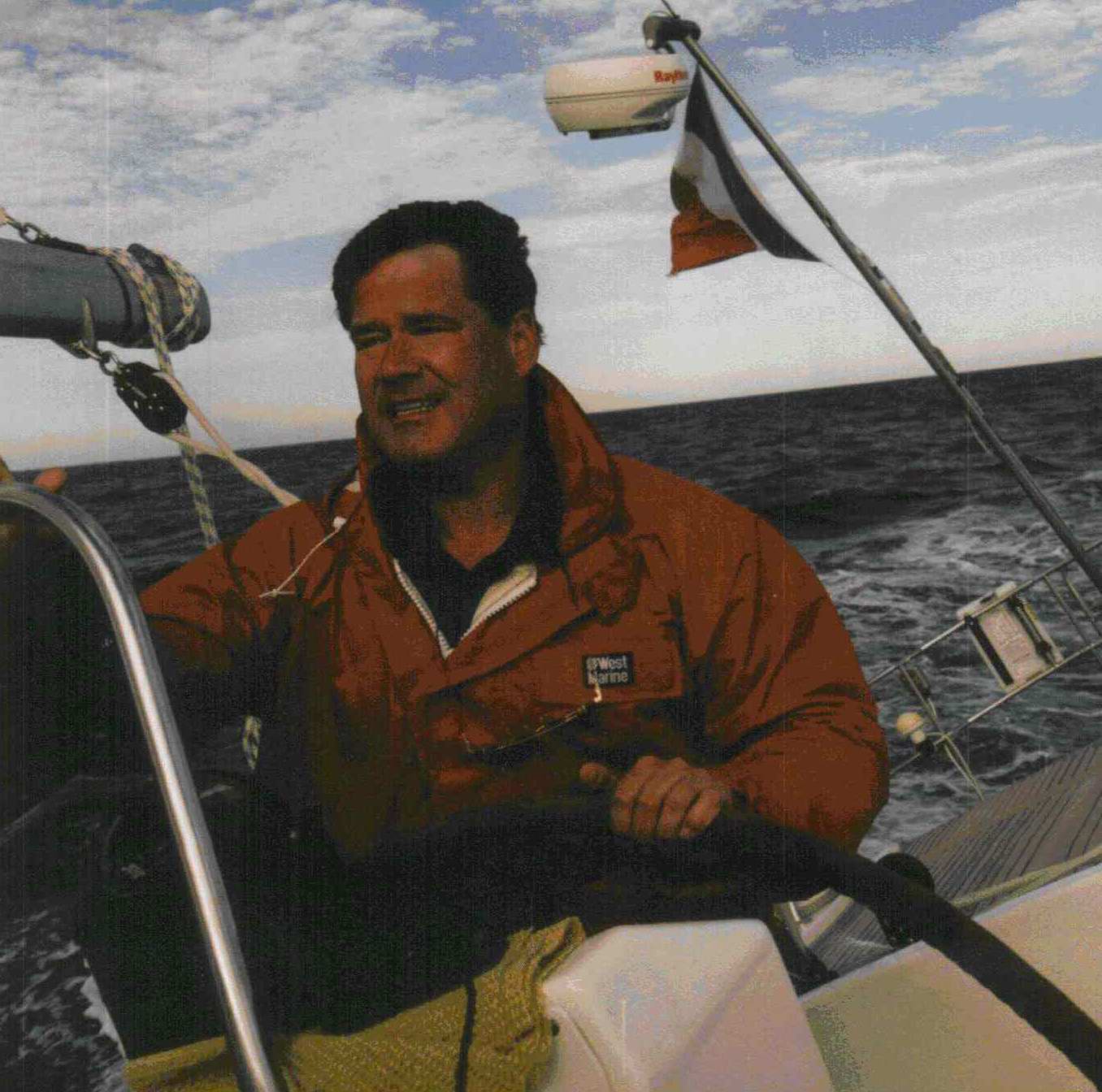

Mr.

Macdonald has three children and resides from May to September in

Providence, RI. He enjoys sailing in the summers and skiing in the

winter. Several times each year he will disgrace his heritage on the

golf course.

|